life insurance

in one place

0%

22 million

Canadians have life insurance coverage, totalling $5 trillion.

0%

26 million

Canadians have supplementary health insurance.

0%

Living policyholders

Over 90% of benefit payments went to living policyholders.

0%

Individual policies

Over eighty per cent of life insurance premiums are paid to purchase

individual policies.

Protecting your home

Often your property is one of the biggest investments you will make in your lifetime, so it would make sense to protect your home, should anything happen to you. You can then be comforted knowing that your family won’t have this financial burden when they are facing a difficult time and they can remain in your home for their future.

Protecting your partner

If anything should happen to you then your partner will need to still take care of the household expenses and bills. Think about your regular household expenses and savings to understand how long your partner could last without your income and how much money the family would need.

Protecting children

The cost of childcare is one of the biggest expenses for the family; especially if your children are thinking of attending college or university in the future, so think about how you can protect those opportunities for your children.

Whole Life insurance

Knowing your family are financially protected should the worst happen to you can give you the reassurance you need to concentrate on the people who matter most.

Term life insurance

Term life insurance is life insurance that pays out a one-off lump sum if you become ill or die during the policy’s term. You or your family can use the payout for anything like paying off the mortgage, and other debts.

Simplified Life Insurance

If existing conditions, a dangerous occupation, medical testing, or time crunch affects your ability to find life insurance, simplified issue life insurance can provide a solution.

Critical Illness Insurance

Almost everyone knows someone who has been affected by a life-changing condition such as cancer, stroke, heart disease or a serious accident.

Health Insurance

Medical bills can add up, from prescription drugs, dental checkups, physiotherapy, eyeglasses and so forth.

Advisory

Have a chat with Mana Life about your current circumstances and the reasons you're looking for cover.

What our clients say

The service received was very good with excellent advice and assistance for a great deal

- Samantha May -

My decision for life insurance cover was very quick because Mana Life has the best insurance deals and good customer service as compared to others.

- Jane Blake -

The staff here is very helpful, they explained to me in detail about the policy. They understood my situation and provided me with life insurance with very affordable premiums. Thank You, Guys.

- Jeans Kennedy -

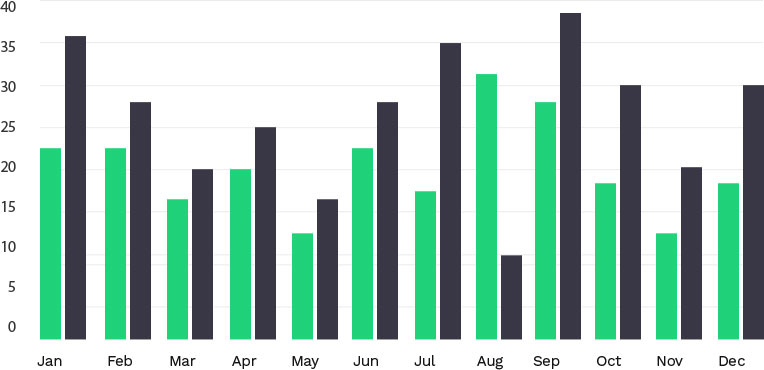

We leverage big data and data analysis to offer the best price to our clients

Calculate your way toward profit

Highlight crucial information

Create an image showcase

FAQs

What is life insurance?

Life Insurance pays out a sum of money to your family should you pass away.

There are different types of Life Insurance, so it’s important you choose the right cover for you.

Do I need Life Insurance?

Everyone’s circumstances are different and not everyone needs Life Insurance. But if your children, partner or other relatives depend on your income to cover things such as a mortgage, household bills or other living expenses, then the answer is probably ‘yes’, as it will help provide for your family in the event of your death.

How does life insurance work?

Life Insurance helps you protect the ones you love should the worst happen. Our life cover pays out a cash lump sum if you pass away during the policy term, over this period you pay monthly premiums to Mana Life.

Who needs life insurance?

Most people buy life insurance when they’re starting a family, getting a mortgage on a house, marrying their partner, or nearing retirement.

How Canadians buy life and health insurance?

Total premiums in Canada rose to $122 billion in 2019. Year-over-year growth was led by annuities (including segregated funds), up 5.2 per cent; followed by life insurance, up 5.1 per cent; and health insurance, up 4.1 per cent.

What are supplementary benefits?

Supplementary benefits, such as payments on accidental death, disability, or critical illness – or waiver of required premiums upon disability – can be added to l ife insurance products.